I have been doing consultancy for different developers in the Philippines and an item that a developer wants to decrease is back outs due to inability to pay of a client. With stretched downpayments of 3,4,5 and even 6-year-payment terms, a buyer’s monthly investment of Php8,000 to Php15,000 is very affordable and manageable. This downpayment terms range from 10,20 or 30% equity of the total amount. Thus, after the specified term, a buyer will have to pay the balance from 90, 80, or 70% of the remaining price.

Sample: A Bonifacio Global City condominium with the size of 36.5 sqm and selling at Php100,000/sqm. The value of the property becomes Php3,650,000.00. Take 20% of that amount (Php730,000) and spread it over 5 years or 60 months. You will get an equal monthly payment of Php12,167.00. The balance of 80% will be paid after 60 months (Php2,920,000). A developer may offer an 18% interest for 5 years or (P74,138/mo) or 21% interest for 10 years (Php58,370). This is a long jump form the downpayment. Thus, there are backouts. Depending on the cash flow of the developer – this may be both a good and bad position.

From the buyer’s standpoint, or any person for that matter, – losing money is never a good option. A buyer may re-sell but depending on a lot of factors, even selling at a bargain may not be acceptable for the secondary market.

I Need a Property That is Already Ready For Occupancy

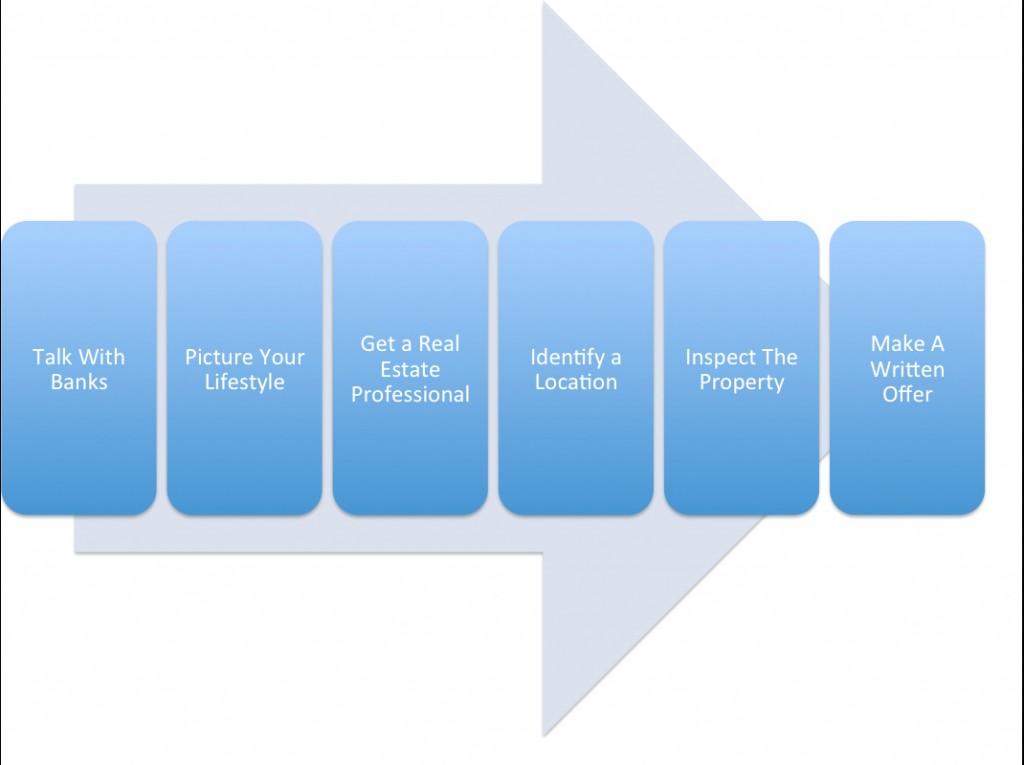

If you are buying a property that is ready for occupancy then the best option that you should do is do the correct steps. For OFWs, balikbayans, retirees, businessmen and most of us for that matter – buying a property is the most expensive purchase in our life. It is best to be in a position to negotiate when you are prepared. We are often asked about the process in the Philippines and I thought it might be helpful for home buyers to have an actual list with some references. Whether you’re a home buying first-timer or you’ve purchased a property before the process is pretty much the same:

1. Talk to Banks

2. Picture Your Lifestyle

3. Choose Your Real Estate Professsional That Will Work For You

4. Identify a Location

5. View The Property

6. Make an Offer In Writing

Talk To Banks. This very important first step is sometimes skipped over by even the experienced buyer. Nothing can be more disappointing than finding a property that you love only to realize that you either cannot obtain a loan or you cannot afford the payment for that property. Banks offer a lot of flexible payments from a fixed rate to a very low interest.

Picture Your Lifestyle. Why are you buying this property again? Does it replace your car, will it give twice business, does it multiply your ‘time’? Some amenities can be difficult to locate in some price ranges. Knowing why you are buying can be very helpful when beginning your home search.

Choose a Real Estate Professional. Choosing the right licensed broker to represent you can make the rest of the process easier. Philippine Real estate agents and brokers are NOT all the same. In the Philippines, there are also a lot of colorum or unlicensed agents and practitioners calling themselves brokers. Experience and expertise can vary GREATLY! Is your agent doing this full time or only on weekends? Is your next door neighbor or the agent you met at the mall really the best choice for you? A common mistake is that a potential buyer will locate the property before locating a licensed broker. You need to work with somebody whom you like and will represent you. I have been blessed to get inquiries and referrals who will ask for some advice on purchases in the Philippines. Sometimes, their requirement is not available in the market in the price that they want or in the orientation they prefer (e.g. facing east, facing SouthEast). When we have pinpointed their location we concentrate our efforts there. When they are the ones who will find a property – they will call me to check it out and represent them. This is both good for my business and also for theirs as I will make sure that they get the best deal.

It also happens that a buyer will call directly a property with a “For Sale” number. However, most of the time, the person with that number already has an agreement to represent the best interests of the seller. Although they can help you purchase the property it is extremely difficult for one agent to give their best representation to both parties.

I LIKE THE PROPERTY BUT NOT THE SELLER

Another problem we often see with first time buyers is that they view a lot of properties with a number of different agents. Once you have been shown a home by a broker, that broker is considered to be working with you for that particular property. This can be a difficult situation if you locate the perfect home but you happen to be with a broker you don’t feel comfortable working with. Get a real estate professional who will represent you first.

Make An Offer In Writing

There are times when a seller would reconsider something with an earnest money and written offer. It shows sincerity and professionalism which a seller may appreciate.